The Bank of England decided to raise interest rates in the U.K. by 50 basis points in its bid to control inflation, but economists around the world agree that this move will take the British economy into a recession faster than expected and more severe.

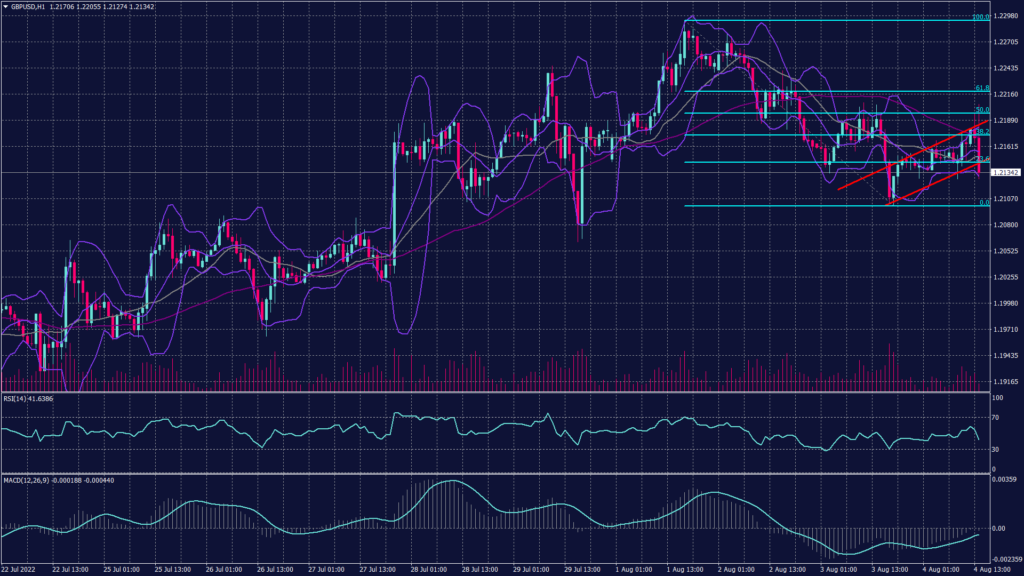

The British pound fell victim to the British Central Bank’s decision to raise interest rates with the largest jump since 1995, which is expected to drop the pound to 1.20750 and then 1.2030 if it is broken. This pressure brought the pound back to the bearish trend that targets 1.17550 in the medium term and 1.2010 in the near term. Anyway, the hourly curve is targeting 1.2075.

| Support | Resistance |

| 1.2100 | 1.2130 |

| 1.2075 | 1.2170 |

| 1.2037 | 1.2185 |

Tags

Open Live Account

Please enter a valid country

No results found

No results found

Please enter a valid email

Please enter a valid verification code

1. 8-16 characters + numbers (0-9) 2. blend of letters (A-Z, a-z) 3. special characters (e.g, !a#S%^&)

Please enter the correct format

Please tick the checkbox to proceed

Please tick the checkbox to proceed

Important Notice

STARTRADER does not accept any applications from Australian residents.

To comply with regulatory requirements, clicking the button will redirect you to the STARTRADER website operated by STARTRADER PRIME GLOBAL PTY LTD (ABN 65 156 005 668), an authorized Australian Financial Services Licence holder (AFSL no. 421210) regulated by the Australian Securities and Investments Commission.

CONTINUEImportant Notice for Residents of the United Arab Emirates

In alignment with local regulatory requirements, individuals residing in the United Arab Emirates are requested to proceed via our dedicated regional platform at startrader.ae, which is operated by STARTRADER Global Financial Consultation & Financial Analysis L.L.C.. This entity is licensed by the UAE Securities and Commodities Authority (SCA) under License No. 20200000241, and is authorised to introduce financial services and promote financial products in the UAE.

Please click the "Continue" button below to be redirected.

CONTINUEError! Please try again.